Advertisement

-

Published Date

June 16, 2018This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

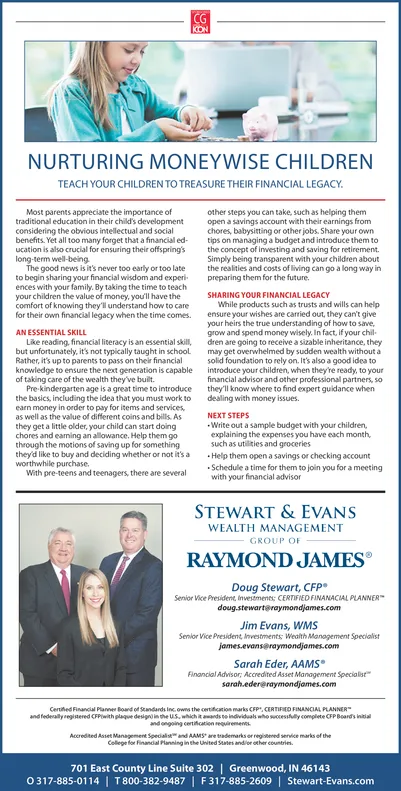

CG NURTURING MONEYWISE CHILDREN TEACH YOUR CHILDREN TO TREASURE THEIR FINANCIAL LEGACY Most parents appreciate the importance of traditional education in their child's development considering the obvious intelectual and social benefits. Yet all too many forget that a financial ed ucation is also crucial for ensuring their offsprings long-term wel-being. other steps you can take, such as helping them open a savings account with their earnings from chores, babysitting or other jobs. Share your own tips on managing a budget and introduce them to the concept of investing and saving for retirement. Simply being transparent with your children about The good news is it's never too early or too late therealities and costs of living can go a long way in to begin sharing your financial wisdom and experi prepaing them for the future. ences with your family. By taking the time to teach your children the value of money, youll have the comfort of knowing they'll understand how to care for their own financial legacy when the time comes. ensure your wishes are carried out, they can't give SHARING YOUR FINANCIAL LEGACY While products such as trusts and wills can help your heirs the true understanding of how to save, grow and spend money wisely. In fact, if your chil AN ESSENTIAL SKIL Like reading, financial literacy is an essential skill, dren are going to receive a sizable inheritance, they but unfortunately, it's not typically taught in school may get overwhelmed by sudden wealth without a Rather, it's up to parents to pass on thelr financi id foundation to rely on, It's also a good idea to knowledge to ensure the next generation is capable introduce your children, when they're ready, to your of taking care of the wealth they ve bult. financial advisor and other professional partners, so Pre kindergarten age is a great time to introduce they'll know where to find expert guidance when the basics, including the idea that you must work to dealing with money issues earn money in order to pay for items and services NEXT STEPS as well as the value of different coins and bills As they get a little older, your child can start doing chores and eaning an allowance. Help them go through the motions of saving up for something they'd like to buy and deciding whether or not it's worthwhile purchase. Write out a sample budget with your children, explaining the expenses you have each month such as utinies and groceries a Helpthem open a savings or checking account With pre-teens and teenagers, there are several Schedule a time for them to join you for a meeting with your financial advisor STEWART & EVANS WEALTH MANAGEMENT GROUP OF RAYMOND JAMES Doug Stewart, CFP Senior Vice President, Investments CERTIFNED FINANACIAL PLANNER doug.stewart raymondjames.com Jim Evans, WMS Senor Vice President nvestments Wealth Manegement Specialist jamesevans raymondjames.com Sarah Eder, AAMS Financial Advisor Accredited Asset Management Specialist Accredited Asset Management Spedai and AAMSare trademarks or regbeed serice marks of the Coege for Finaial Planning in the United Stes andor ther countri. 701 East County Line Suite 302 | Greenwood, IN 46143 0 317-885-0114 T800-382-9487 I F 317-885-2609 | Stewart-Evans.com